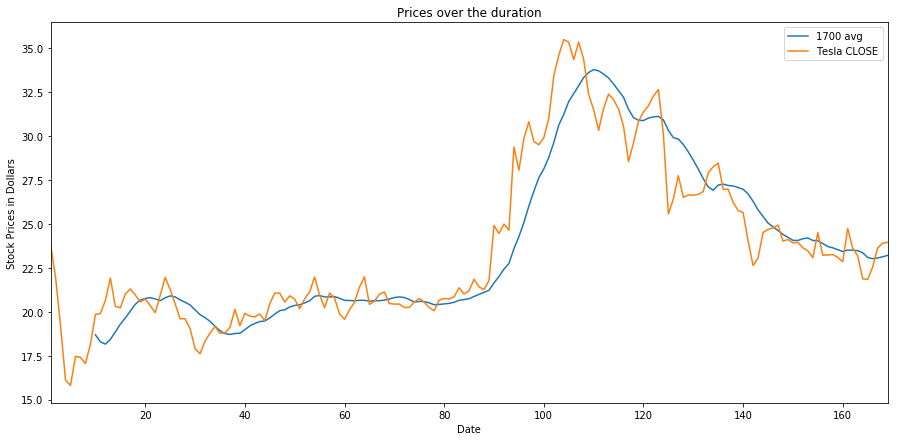

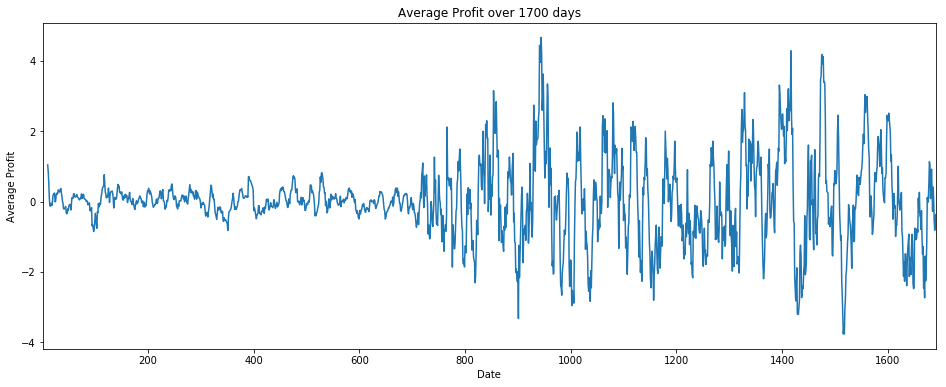

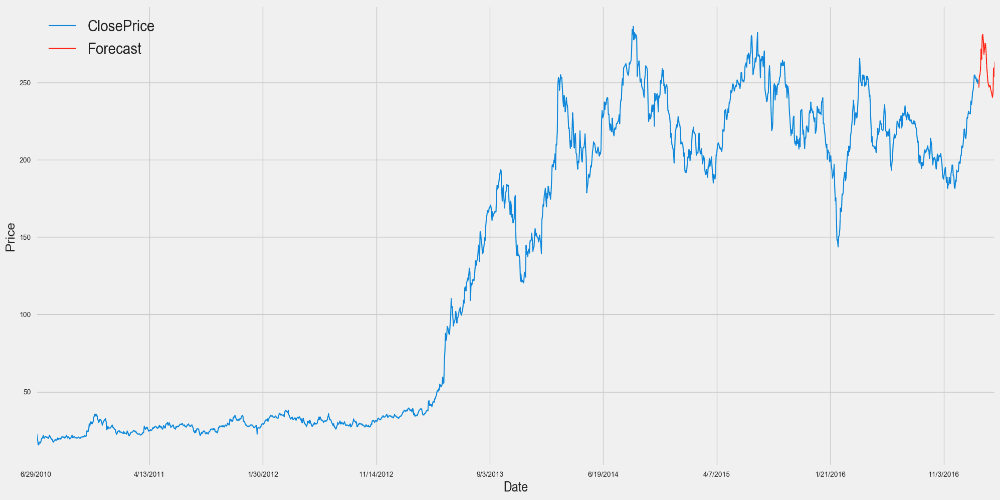

Descriptive Analysis

Investors depend on stock analysis to find potentially profitable stocks. The maximum profit per share booked in a single day: 20.51 Dollars The change rate through that Day: 25.74 % The minimum profit booked per share in a single day: -20.77 Dollars The change rate through that Day: -19.75 %